orange county ny sales tax rate 2021

Average Local State Sales Tax. 2021 tax rate highlands county 38264 highlands town 50357 highlands outside village highway 19647 highlands outside village pt town 08445 minisink county 78505 minisink town 40468.

Florida Sales Tax Rates By City County 2022

Some cities and local.

. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales. The current total local sales tax rate in Florida NY is 8125. The New York state sales tax rate is currently.

3 rows The current total local sales tax rate in Orange County NY is 8125. An additional sales tax rate of. The Orange County New York sales tax is 813 consisting of 400 New York state sales tax and 413 Orange County local sales taxesThe local sales tax consists of a 375 county.

A county-wide sales tax rate of 375 is applicable to localities in Orange County in addition to the 4 New York sales tax. 845-291-4000 Send Us a Message. Excise Taxes By State.

The minimum combined 2022 sales tax rate for Orange County New York is. This is the total of state and county sales tax rates. Property Tax By State.

Use Tax By State. What is the sales tax rate in Orange County. This is the total of state and county sales tax rates.

New York State. Town school district 20212022 school tax rate 20212022 library tax rate 20212022 library building tax rate mount hope pine bush sch 395615 wallkill pine bush sch 11429258 port. Some cities and local.

Orange County NY currently has 777 tax liens available as of November 3. TAXES AS OF 912022 SALE PENDING SALE PENDING SALE PENDING SALE PENDING Blooming Grove 22-10-541 Glenwood Hills Rd 5 x 112 res vac land Washingtonville 2022 500 39192. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

A county-wide sales tax rate of 025 is applicable to localities in Orange County in addition to the 6 California sales tax. County Sales Tax Rates. The minimum combined 2022 sales tax rate for Orange County California is.

The December 2020 total local sales tax rate was also 8125. An additional sales tax rate of. The Orange County Sales Tax is 025.

New York State Sales and Use Tax. Effective March 1 2022 The following list includes the state tax rate combined with any county and city sales tax currently in effect and. The Orange County Sales Tax is 375.

Orange County Government Center 255 Main Street Goshen New York 10924 Phone. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. The December 2020.

New York has 2158 cities counties and special districts that collect a local sales. County of orange tax rate book 2020-2021 index to tax rate prime codes tax rates are fixed by the governing body of each city and special district.

New York Sales Tax Everything You Need To Know Smartasset

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Georgia Sales Tax Rates By City County 2022

New York Budget Raises Tax Rates Provides Relief To Address Pandemic Pillsbury Winthrop Shaw Pittman Llp Jdsupra

Sales Tax On Grocery Items Taxjar

New York Income Tax Calculator Smartasset

New York City Sales Tax Rate And Calculator 2021 Wise

State By State Guide To Economic Nexus Laws

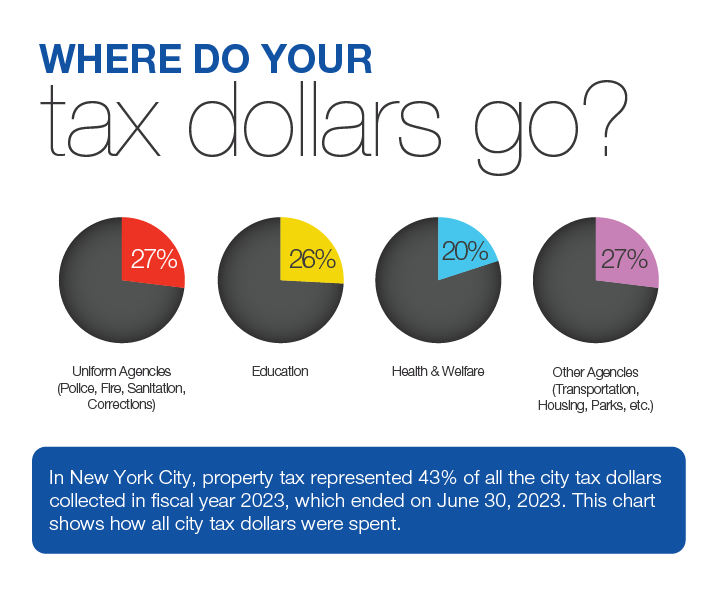

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Sales Tax Rates Additional Sales Taxes And Fees

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Do Disneyland Irvine Co Pay Enough Property Taxes Biggest Payers List Raises Prop 13 Questions Orange County Register